After the long phase of the financial crisis, followed by the sovereign debt crisis and the stagnation, the international economy was substantially stabilized, but at the cost of greatly divergent policies of central banks, which led to a high volatility in the exchange rates and laid the premises for acute currency turmoil that can affect the real economy.

The action of the international organizations - and in particular of the IMF - was particularly effective in the first phase, with significant operative innovations such as the issue of securities of the IMF itself signed by the BRICS countries, and particularly by China.

At the institutional level, the reform of the IMF quotas and of its governance was initiated in order to increase the involvement of the new countries, and has recently become more necessary than ever in the new context of volatile currency exchange rates. To ensure that the IMF remains at the center of the multilateral economic system and contributes to the stabilization of the world economy, it is in fact of crucial importance the approval of the 2010 quotas and the governance reforms.

The growing role of bilateral agreements and the establishment of international institutions of emerging countries such as the BRICS' New Development Bank and the Asian Infrastructure Investment Bank show that, without that agreement, an alternative framework is adopted, shifting the issues to new bodies.

This reform (which requires an 85% majority of the total voting power) was blocked for some time by the US Congress. The US Congressional approval of the 2010 Quota and Governance reforms, announced in December 2015, was therefore welcomed by the IMF Managing Director as “a crucial step forward that will strengthen the IMF in its role of supporting global financial stability […] enabling us to respond to crises more effectively, and also […] better reflecting the increasing role of dynamic emerging and developing countries in the global economy”.

The reform1 envisages a shift of more than 6 percent of quota shares to dynamic emerging and developing countries, and also from over-represented to under-represented members.

The entry into force of the governance reform of the IMF would result in a decrease of the European countries' representation in the Executive Committee by two chairs2, putting strongly forward the need - particularly in the Eurozone - of achieving forms of common representation.

The President of the Commission, J.P. Juncker, at the time of his assignment had indicated the need to reach a common representation of the Euro countries in the international monetary system, remembering how the Lisbon Treaty - in particular Art. 138 of the TFEU - envisages the procedure to achieve this goal.

In line with this intention, in October 2015 the European Commission issued a proposal for a Council decision to lay down “measures in view of progressively establishing a unified representation of the euro area in the IMF.” The proposal suggests moving to a unified representation for the euro area in the IMF, with the President of the Eurogroup as the representative for the euro area.

While it sets 2025 as the deadline for reaching this goal at the latest, it also details transitional arrangements and a gradual approach involving intermediate transitional steps for representation in the International Monetary and Financial Committee (IMFC) and the IMF Executive Board.

With respect to the continuation and deepening of these efforts to bring about a more robust international monetary and financial system, which in turn will support the global economy and the growth and stability of China, the IMF has recently announced a change of paramount importance.

In November 2015, during the five-year review of the SDR basket, the Executive Board of the IMF determined that the Chinese renminbi meets the selection criteria for the SDR basket, and announced that, effective from October 2016, the Chinese renminbi will be added to the SDR as its fifth currency. The inclusion of the RENMINBI will enhance the attractiveness of the SDR by diversifying the basket and making it more representative of the world’s major currencies.

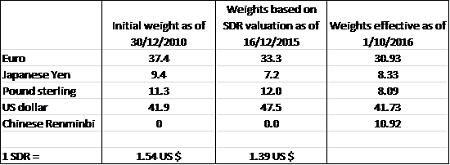

The new weights3 within the basket will be: US dollar (41.73%), euro (30.93%), Chinese renminbi (10.92%), Japanese yen (8.33%), Pound sterling (8.09%). The respective weights at the time of the 2010 review were: US dollar (41.9%), euro (37.4%), Japanese yen (9.4%), and Pound sterling (11.3%). At first sight one could conclude that the introduction of the renminbi was made mainly at the expenses of the euro. In reality, a number of mechanisms play their role in this change and need to be taken into account.

1) The update of the figures which are at the basis of the currency weights.

Applying the same 2010 formula for the calculation of the different weights, but using 2015 figures rather than 2010 figures would determine an increase of the weight of the US dollar by about 3 percentage points. In 2010, to determine currency weights a method dating back to 1978 was applied. Each currency’s weight was endogenously derived by adding the issuer country’s exports (flow) and the amount of the currency held in other countries’ reserves (stock), both expressed in SDR. The relative weights of exports and reserves in the 2010 review were about 67% and 33%, while using latest data would be about 60% and 40%. Each currency’s weight would be broadly unchanged from the last review with an increase in the share of the US dollar by three percentage points and a drop of the pound’s weight by 2 ½ percentage points.

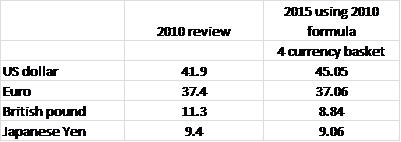

Table 1 . Currency weights (%)

This was due to two factors. First, for the period under review, reserves increased more quickly than exports, raising the weight of the dollar because of its high share in reserves. Second, US export growth was higher than that of the euro area, Japan and the UK. The weight of the British pound would fall by 2 ½ percentage points due to negative export growth, while the weights of the euro and the yen would decline marginally.

2) Review/change in the weighting formula of the SDR.

In the 2015 review, the shortcomings of the old formula were addressed and a new weighting formula was used. The new formula gives equal shares to exports and to the financial indicator, which was broadened to include also private finance variables. The weights for each variable are fixed and not derived endogenously by summing a flow (exports) and a stock (reserves) variable. Therefore, the weight attributed to exports is 50% and the remaining 50% is attributed to the financial indicator with reserves, foreign exchange turnover and the sum of International Banking Liabilities and International Debt Securities, now having an equal weight of one third of the financial indicator. The new formula increases the weight of the financial variable and it gives weight to private transactions, that did not exist before. Since the share of the euro is generally lower for financial indicators than for exports, while the share of the dollar in financial indicators is higher, this results in a shift of weight from the euro principally to the US dollar, with smaller increases in the weight of the British pound and the Japanese yen.

3) The introduction of a fifth currency in the basket.

The inclusion of the renminbi affects the SDR currencies primarily by diluting their shares of exports. The renminbi has a relatively low share in the financial variables, so most of its weight in the SDR basket derives from China’s standing as third-largest exporter. Since the euro also derives a relatively large proportion of its weight from exports, it is also the most affected by the introduction of the Chinese currency, with a fall of some 5 percentage points solely linked to this introduction. A paper of the IMF in July estimated around 14% the possible weight of the renminbi as fifth currency based on 2010 formula, while with the new formula and the increased weight of the financial indicator the final weight attributed to the renminbi was around 11%.

While the change of the currency weights in the basket is linked to the above mentioned variables, it is interesting to see the movements in the currency exchange rates and their effects on the relative weights.

Table 2. Currency weights (%)

If we look at the two major currencies included in the 2010 basket, we can note that in the last five years the euro depreciated against the US dollar by over 15%. Considering that the currency amounts are fixed at every review, the weights fluctuate depending on the exchange rates of the currencies included in the basket. If we look at the SDR currency value, which is calculated daily, and to the relative weights as of December 16th, 2015, we see that the effects of this movements are relevant. Following these adjustments, the share of the euro had already decreased and the US dollar’s had gained weight.

The existing rules on the revision of the SDR basket are seen by many market operators as a limit to develop the use of the SDR. For short term operations, the revision clearly is not a problem. For longer investments apparently this can be seen as a handicap, but in reality it is an opportunity to invest in currencies with a limited international use that can become in the coming years fully developed, as is the case for the renminbi and other currencies. The enlargement of the basket gives to investors an opportunity to invest/diversify in currencies with a growing international role.

The decision to introduce the renminbi in the SDR basket is in line with what advocated by the Robert Triffin International in the Report “Using the SDR as a lever to reform the International Monetary System”. In the Report, the introduction of the renminbi, and later of other emerging countries’ currencies into the basket, is strongly recommended. The better the basket represents the composition of world GDP, the more the Triffin dilemma would be reduced.

1 Four emerging countries (Brazil, China, India and Russia) will be among the ten largest members of the IMF. Other top 10 members include the United States, Japan, and the four largest European countries (France, Germany, Italy, and the United Kingdom). IMF Press Release, 15/573, December 18th, 2015.

2 Advanced European countries will reduce their combined Board representation by two chairs at the latest by the time of the first election after the quota reform takes effect. IMF Press release 10/418, November 5th, 2010.

3 The weights will be used to determine the amounts of each of the five currencies in the new SDR basket that will take effect on October 1, 2016.

Log in